Gold Prices Drop Sharply in Pakistan

Major Fall in Gold Prices Across Pakistan

Gold prices in Pakistan took a notable dip on Wednesday, marking one of the steepest daily declines in recent weeks. The price of 24-karat gold slid by Rs. 3,500 per tola, following a similar downward trend in the international bullion market. According to the All Pakistan Sarafa Gems and Jewellers Association (APSGJA), the latest rate for 24-karat gold stands at Rs. 429,362 per tola, while 10 grams of the same purity are now priced at Rs. 360,392. This drop reflects growing uncertainty in global markets as investors react to fluctuating interest rates and the strengthening of the US dollar.

Today’s Gold Rate in Pakistan – November 5, 2025

| City | 24K Gold (Per Tola) | 24K Gold (Per 10g) | Silver (Per Tola) |

|---|---|---|---|

| Karachi | Rs. 429,362 | Rs. 360,392 | Rs. 5,022 |

| Lahore | Rs. 429,362 | Rs. 360,392 | Rs. 5,022 |

| Islamabad | Rs. 429,362 | Rs. 360,392 | Rs. 5,022 |

| Peshawar | Rs. 429,362 | Rs. 360,392 | Rs. 5,022 |

| Quetta | Rs. 429,362 | Rs. 360,392 | Rs. 5,022 |

| Sialkot | Rs. 429,362 | Rs. 360,392 | Rs. 5,022 |

| Hyderabad | Rs. 429,362 | Rs. 360,392 | Rs. 5,022 |

| Faisalabad | Rs. 429,362 | Rs. 360,392 | Rs. 5,022 |

| Meanwhile, silver remained stable at Rs. 5,022 per tola and Rs. 4,305 per 10 grams. |

Also Read: State Bank of Pakistan Loan Scheme 2025

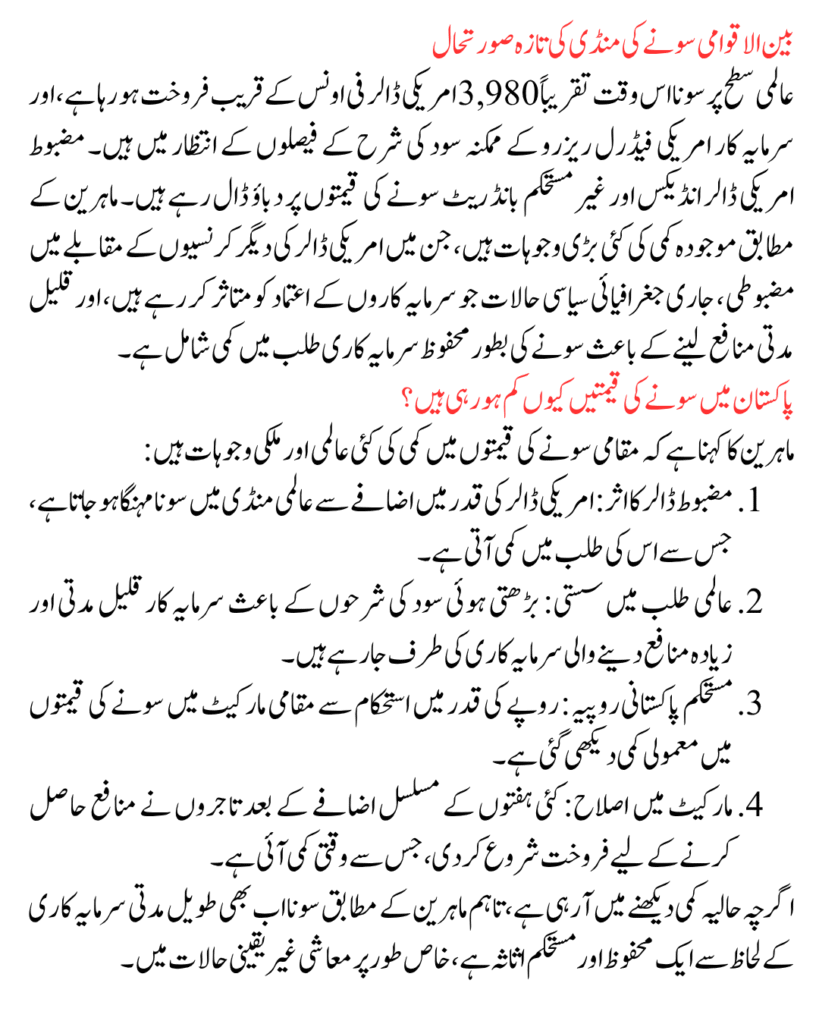

International Gold Market Update

On the global front, gold is currently trading around $3,980 per ounce, extending losses as investors brace for possible interest rate decisions by the US Federal Reserve. The firm US dollar index and volatile bond yields continue to exert pressure on precious metal prices. Market analysts point to several factors driving the current downtrend: the US dollar’s strength against other major currencies, ongoing geopolitical uncertainties affecting investor confidence, and reduced demand for gold as a safe-haven asset amid short-term profit-taking.

Why Are Gold Prices Falling in Pakistan?

Experts say multiple global and domestic factors are influencing the decline in local gold rates. 1. Stronger Dollar Effect: A robust US dollar makes gold more expensive internationally, lowering demand. 2. Slower Global Demand: Many investors are moving to short-term, high-yield assets as interest rates rise. 3. Stable Pakistani Rupee: A steadier exchange rate has slightly eased domestic gold prices. 4. Market Correction: After weeks of price gains, traders are cashing in profits, triggering short-term corrections. Despite this dip, analysts maintain that gold remains a solid long-term investment, particularly during periods of economic instability.

Gold: The Reliable Hedge Against Uncertainty

Gold continues to hold its place as one of Pakistan’s most trusted assets. Whether in the form of jewelry, bullion, or digital gold, it remains a symbol of financial security and a shield against inflation. Historically, gold has performed well during times of currency depreciation and economic slowdowns, making it a preferred choice for investors seeking stability.

Gold Price Trends in 2025

Throughout 2025, gold prices in Pakistan have swung in response to global developments.

| Month | Average Price per Tola (24K) | Trend |

|---|---|---|

| January 2025 | Rs. 417,000 | Steady Rise |

| April 2025 | Rs. 435,500 | Upward |

| July 2025 | Rs. 438,200 | Peak |

| October 2025 | Rs. 432,800 | Slight Decline |

| November 2025 | Rs. 429,362 | Downtrend |

| Experts expect continued volatility through the final quarter of 2025, with market sentiment tied closely to oil prices, interest rates, and global inflation data. |

Silver Prices Remain Stable

While gold prices slipped, silver rates in Pakistan held steady at Rs. 5,022 per tola and Rs. 4,305 per 10 grams. Analysts note that silver’s affordability and industrial demand make it attractive for small investors and sectors like electronics and manufacturing.

What’s Next for Gold? Expert Insights

Market watchers predict gold may continue trading between $3,950 and $4,050 per ounce internationally in the coming weeks. Locally, prices are expected to fluctuate depending on the rupee-dollar exchange rate. If inflationary pressures rise again or global tensions escalate, gold demand could strengthen during Q4 2025. Financial experts advise long-term investors to hold their positions, as gold typically gains when markets face uncertainty.

FAQs – Gold Rate in Pakistan (November 5, 2025)

Q1. What is the current gold price in Pakistan? The 24K gold rate is Rs. 429,362 per tola and Rs. 360,392 per 10 grams.

Q2. Why did gold prices decrease today? The decline follows a drop in international bullion prices and a stronger Pakistani rupee.

Q3. What is the silver price today? Silver stands at Rs. 5,022 per tola and Rs. 4,305 per 10 grams.

Q4. How are gold prices set in Pakistan? Rates are determined by global market trends, US dollar parity, and local demand.

Q5. Is gold still a safe investment in 2025? Yes. Despite short-term dips, gold remains a reliable long-term asset for wealth preservation.

Conclusion: A Buying Opportunity for Investors

The Rs. 3,500 drop in gold prices on November 5, 2025, could offer an attractive entry point for investors and jewelers alike. While short-term market corrections are common, gold continues to be a cornerstone of financial security in Pakistan. As global markets shift and economic policies evolve, gold stands firm as a trusted hedge against inflation and a valuable long-term investment. Stay updated with daily rates and expert insights to make informed investment decisions across Pakistan.

Related Posts