Asaan Karobar Card Resubmission 2026: Apply For Interest Free Business Loans

Asaan Karobar Card Resubmission

Starting or running a small business in Pakistan is not easy, especially when finance becomes a barrier. The Asaan Karobar Card Resubmission 2026 brings a fresh opportunity for shopkeepers, freelancers, and micro-entrepreneurs who were previously rejected or left incomplete. This program allows eligible applicants to correct mistakes, resubmit documents, and secure interest-free business loans in Year 1 through a simple digital process.

Also Read ; Today’s New Solar Panel Prices 2026

| Feature | Details |

|---|---|

| Scheme Name | Asaan Karobar Card Resubmission 2026 |

| Main Purpose | Interest-free business financing |

| Eligible Users | Shopkeepers, freelancers, micro-entrepreneurs |

| Loan Range | Rs. 50,000 to Rs. 500,000 |

| Markup | 0% in Year 1 |

| Application Mode | Online & Offline |

| Tracking Method | CNIC + Resubmission Number |

| Official Source | Government Asaan Karobar Card Portal |

What Is Asaan Karobar Card Resubmission 2026

The Asaan Karobar Card Resubmission facility is designed for applicants whose earlier forms were rejected, delayed, or left incomplete. Instead of applying again from the beginning, the government allows you to reopen your application, fix errors, and resubmit it within the September 2026 window.

This information is compiled from the official website ensuring accuracy and clarity for applicants.

Who Should Resubmit in September 2026

If your earlier application did not move forward, this resubmission window is for you.

- Applicants with incomplete forms

- CNIC or mobile number entered incorrectly

- Blurry or missing documents

- Applications stuck under review

- New applicants who missed the earlier phase

If you fall in any of these categories, resubmission gives you a second chance without starting from zero.

Loan Slabs and Repayment Structure

The scheme offers flexible loan slabs based on business size.

- Small Business Loan

Rs. 50,000 to Rs. 200,000 with tenure up to 3 years and 0% markup in Year 1 - Medium Enterprise Loan

Rs. 200,001 to Rs. 500,000 with 3–5 years tenure and 0% markup in first year, very low later

Funds are transferred directly to your linked bank account and can be accessed via:

- ATM withdrawal

- HBL Konnect

- JazzCash

Asaan Karobar Card Registration Process

If your profile is incomplete, you must first complete registration.

- Open the official Asaan Karobar Card portal

- Create your account using CNIC and mobile number

- Verify OTP sent to your SIM

- Add business details (shop, stall, freelance work)

- Upload CNIC front/back, photo, and business proof

- Save profile and move to resubmission

Tip: Always use a mobile SIM registered on your own CNIC to avoid OTP failure.

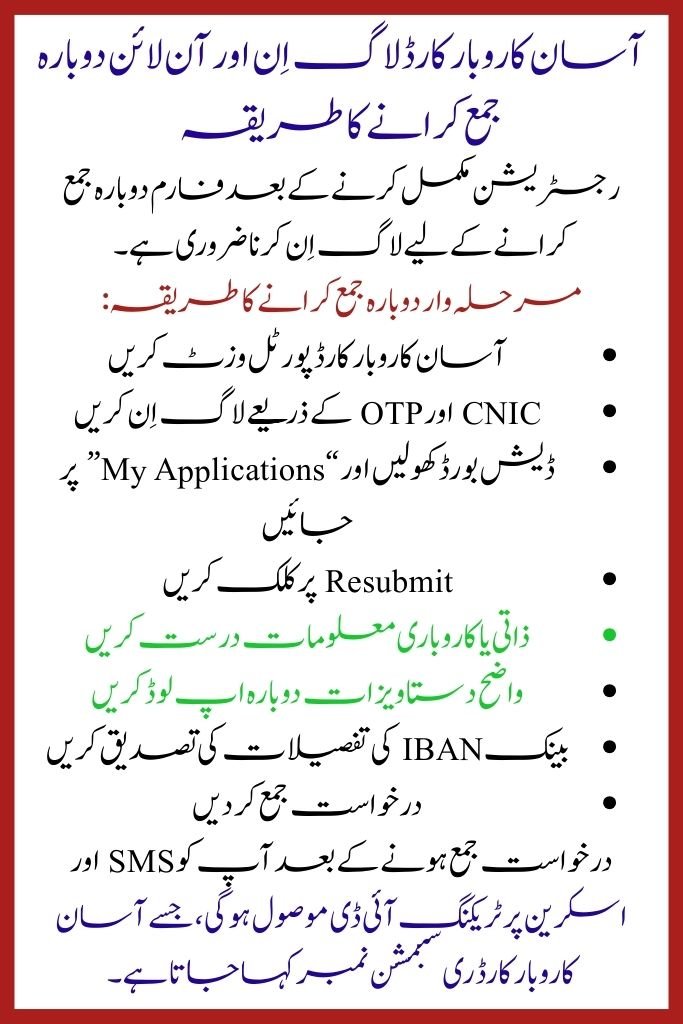

Asaan Karobar Card Login and Online Resubmission

After registration, login is required to resubmit your form.

Step-by-step resubmission process:

- Visit the Asaan Karobar Card portal

- Login using CNIC and OTP

- Open Dashboard and go to “My Applications”

- Click on Resubmit

- Correct personal or business information

- Re-upload clear documents

- Confirm bank IBAN details

- Submit the application

Once submitted, you will receive an SMS and on-screen tracking ID, known as the Asaan Karobar Card Resubmission Number.

Offline Asaan Karobar Card Resubmission Form

Applicants who prefer physical submission can use partner bank branches.

- Visit HBL, UBL, MCB, or Bank Alfalah

- Ask for “Asaan Karobar Resubmission Form”

- Attach CNIC copy and two passport-size photos

- Add business proof and IBAN

- Submit and collect paper receipt

Although offline is available, the online method is faster due to instant verification and SMS updates.

Asaan Karobar Card Resubmission Status Check

You can track your application anytime through the portal dashboard.

Status indicators include:

- Green: Approved – wait for disbursement SMS

- Amber: Query raised – fix remarks immediately

- Red: Not approved – eligible for September resubmission

If “Action Required” appears, correct the issue the same day to avoid delays.

Helpline & Contact Information

For guidance and complaints, applicants can contact official support channels.

- Government helpline numbers listed on the Asaan Karobar Card portal

- Partner bank customer service desks

- Complaint and query section inside the portal dashboard

Helpline information is collected from official website listings and verified but applicants are advised to rely only on government-authorized contacts.

Conclusion

The Asaan Karobar Card Resubmission 2026 is a powerful second chance for small business owners who could not qualify earlier. With 0% markup in the first year, digital tracking, and easy correction of mistakes, the scheme removes common financial barriers.

Use the official portal as your command center. Login with CNIC, fix errors, upload clear documents, confirm IBAN, and submit within September 2026. Save your resubmission number carefully and monitor your status regularly to move from under review to approved without delay.

FAQs

What is Asaan Karobar Card Resubmission?

It allows applicants to correct errors in rejected or incomplete applications instead of applying again from the start.

Is the loan really interest-free?

Yes, the loan carries 0% markup in the first year, as confirmed by official sources.

Can I resubmit without visiting a bank?

Yes, online resubmission through the portal is fully digital and faster.

What is the resubmission tracking number used for?

It is required for status checks, helpline calls, and bank follow-ups, so always save it.

Related Posts