How To Get 7–15 Lac Business Loan by Zarkhaiz-e Asaan Digital Qarza – Complete Guide 2025

Business Loan by Zarkhaiz-e Asaan Digital Qarza

If you are a small business owner, startup founder, freelancer, or shopkeeper in Pakistan and poverty a quick business loan between 7 to 15 lakh rupees, the Zarkhaiz-e Asaan Digital Qarza package can help you. This scheme is calculated to support youth and micro-entrepreneurs by offering digital, fast, and low-markup commercial loans through a fully online process. In 2025, the government further better-quality the scheme to brand it easier to smear, verify leaflets, and get approval without long bank visits.

Below is a complete A-to-Z guide to help you understand eligibility, documents, benefits, and the full application process.

Quick Information Table for Business Loan by Zarkhaiz-e Asaan Digital Qarza

| Field | Details |

|---|---|

| Program Name | Zarkhaiz-e Asaan Digital Qarza |

| Start Date | 2025 (Latest Cycle) |

| End Date | Continues throughout 2025 |

| Loan Amount | Rs. 700,000 to Rs. 1,500,000 |

| Markup | 0% to 5% (based on category) |

| Method of Application | 100% Online (Digital Portal) |

| Disbursement Time | 25–30 Working Days |

| Who Can Apply | Youth, small businesses, startups |

What Is Zarkhaiz-e Asaan Digital Qarza Loan Scheme?

Zarkhaiz-e Asaan Digital Qarza is a digitally managed business loan scheme presented to give support to small and medium business owners across Pakistan. The loan offers interest-free or low-markup financing, contingent on the loan amount and risk profile. This scheme is particularly beneficial for:

- Shopkeepers

- Freelancers

- Women entrepreneurs

- E-commerce sellers

- Small manufacturers

- Home-based businesses

Key Features & Benefits of the Loan

Main Advantages

- Loan Range: Rs. 700,000 to Rs. 1,500,000

- Markup: 0% for small loans, up to 5% for higher slabs

- Collateral Required: Mostly not required

- Application: Fully online and paperless

- Approval Time: 30 working days

- Repayment Tenure: Up to 5 years, easy installments

Why This Scheme Is Important for Pakistan

- Encourages entrepreneurship

- Reduces youth unemployment

- Supports digital transformation

- Strengthens small businesses

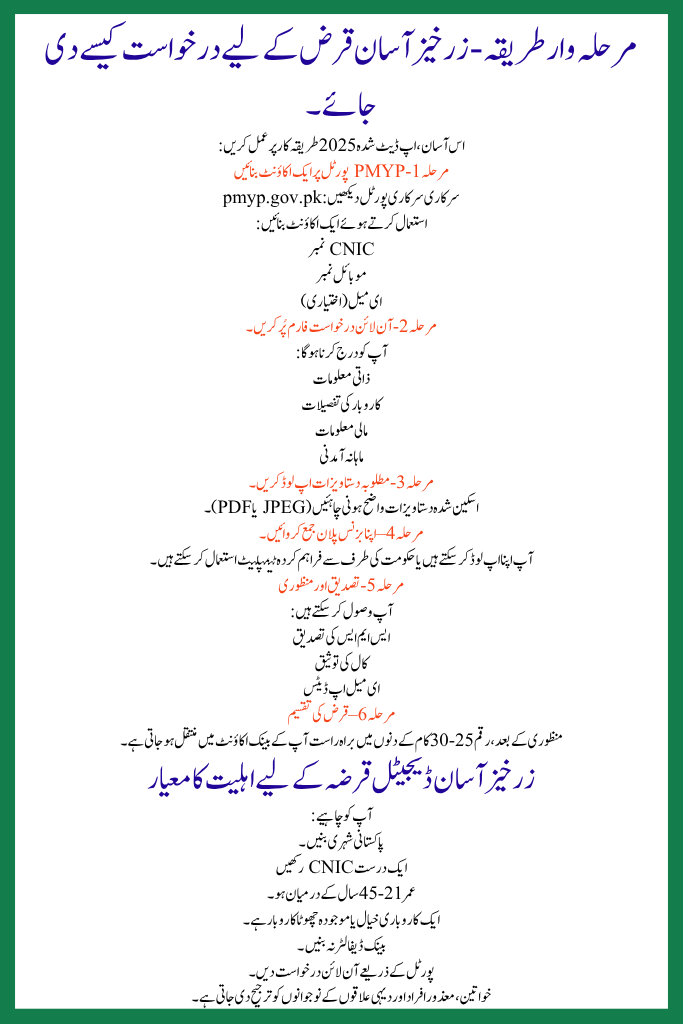

Step-by-Step Method – How To Apply for Zarkhaiz-e Asaan Loan

Follow this easy, updated 2025 procedure:

Step 1 – Create an Account on PMYP Portal

Visit the official government portal: pmyp.gov.pk

Create an account using:

- CNIC number

- Mobile number

- Email (optional)

Step 2 – Fill in the Online Application Form

You must enter:

- Personal information

- Business details

- Financial information

- Monthly income

Step 3 – Upload Required Documents

Scanned documents must be clear (JPEG or PDF).

Step 4 – Submit Your Business Plan

You can upload your own or use the government-provided template.

Step 5 – Verification & Approval

You may receive:

- SMS verification

- Call verification

- Email updates

Step 6 – Loan Disbursement

Once approved, the amount is transferred directly to your bank account within 25–30 working days.

Eligibility Criteria for Zarkhaiz-e Asaan Digital Qarza

You must Business Loan by Zarkhaiz-e Asaan Digital Qarza:

- Be a Pakistani citizen

- Have a valid CNIC

- Be between 21–45 years old

- Have a business idea or existing small business

- Not be a bank defaulter

- Apply online through the portal

Women, differently-abled persons, and youth from rural areas get priority.

Required Documents for the Loan

| Document | Details |

|---|---|

| CNIC | Valid, unexpired |

| Photograph | Passport size |

| Business Plan | Detailed and realistic |

| Bank Account | Must be active |

| Utility Bill | For address verification |

| Business Proof | Optional but helpful |

Tips to Increase Your Approval Chances

- Submit a strong business plan

- Provide correct information

- Keep your bank account active

- Take online training courses

- Respond quickly to calls/SMS

Best Businesses to Start with 7–15 Lac Loan

| Loan Amount | Business Ideas |

|---|---|

| Rs. 7–10 Lac | Mobile shop, fast-food truck, online boutique |

| Rs. 10–12 Lac | Digital printing, solar shop, supermarket |

| Rs. 12–15 Lac | Small manufacturing, mini restaurant, agri tools |

FAQs – Business Loan by Zarkhaiz-e Asaan Digital Qarza

Is this loan interest-free?

Yes, small-tier loans are interest-free; higher tiers have low markup.

Do I need a business registration?

No, a simple business idea is enough.

How long does approval take?

25–30 working days.

Can women apply?

Yes, women receive priority.

Is the application online or offline?

100% online.

Final Thoughts

Business Loan by Zarkhaiz-e Asaan Digital Qarza is a powerful opportunity for anybody in Pakistan who needs to start a occupational but doesn’t have the capital. With a simple online request, flexible payment, and no heavy security requirements, it is one of the best business support schemes for 2025. If you have a good business impression, this is the right period to apply and grow your future.

Related Posts